Chasing Uncharted Dreams

India’s Aerospace and Defence industry has grown substantially in recent years and seems headed for even better days as Government is equally lending its support by way of policy and handholding to chase business opportunities in this sunrise sector

In the last two years the stocks of aerospace and defence sectors have never trundled down the Indian browses despite massive dips in the stock market movement.

And the game-changer was the introduction of Defence Acquisition Procedure (DAP 2020) which has opened up the doors for private participation which hitherto, was restricted or to say literally closed.

DAP 2020 allowed Indian domestic industry through Make in India initiative to participate in the manufacturing activities as it laid down a strict order of preference for procurements.

Similarly, the provision to encourage FDI to establish manufacturing hubs both for import substitution and exports while protecting interests of Indian domestic industry has also pushed the aerospace and defence sectors to be one of the fastest growing segments in the country as several blue-chip transnational companies have invested in this sector.

In addition, what is equally important is the modernisation and indigenisation programmes undertaken by all three services of one of the largest military forces in the world supporting a sustain growth of this mission critical segment of Indian economy.

Ministry of Defence has set a target of achieving a turnover of $26 Bn in aerospace and defence Manufacturing by 2025, which includes $5 Bn exports. Till April 2023, a total of 606 Industrial Licences have been issued to 369 companies operating in Defence Sector.

The constant increase in the defence budgets over the years coupled with increasing governmental support for indigenous defence manufacturing has also propelled the growth of the Aerospace and Defence segment in the country.

Aerospace and Defence sector

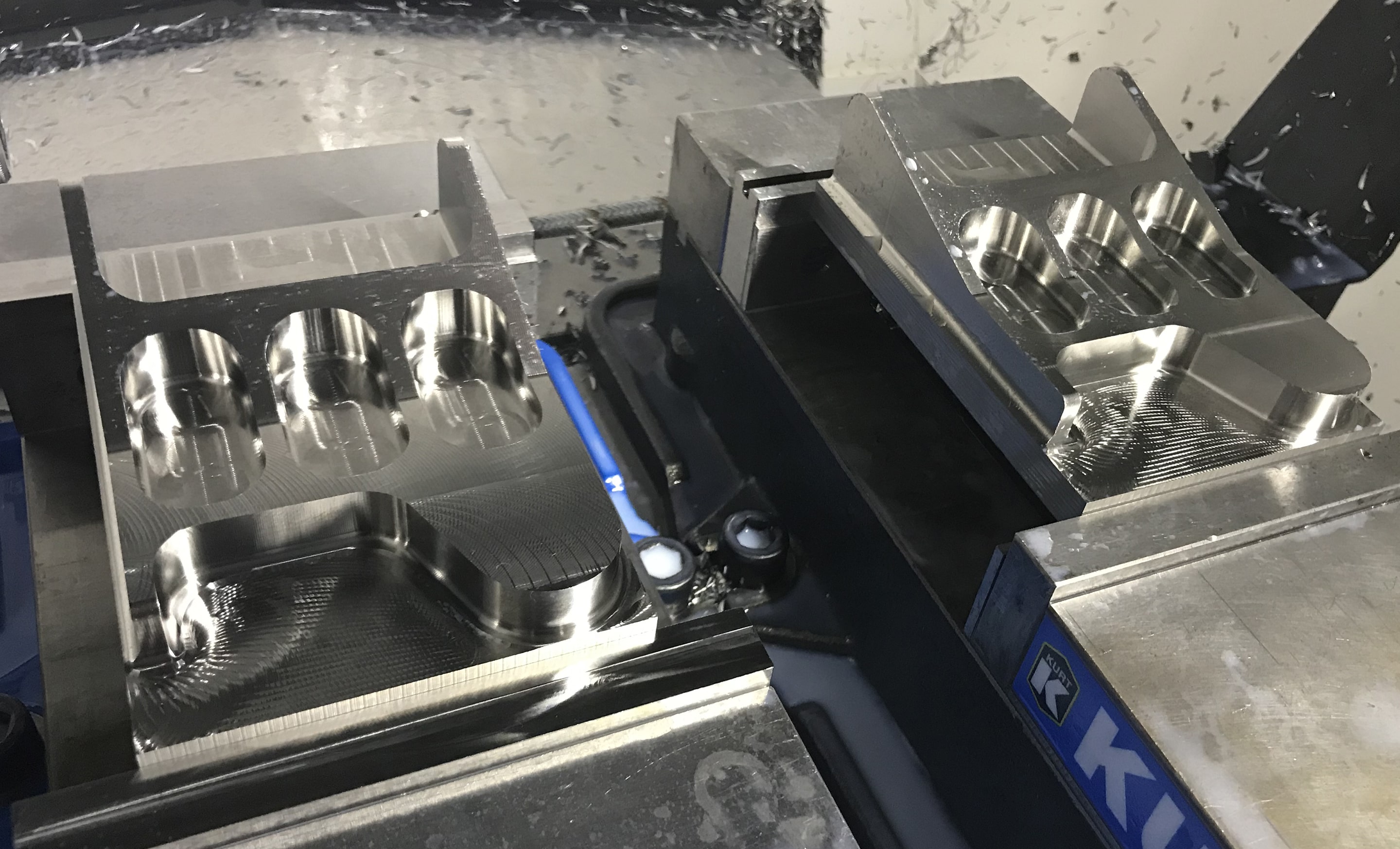

India today is being recognised as the manufacturing and supply chain hub for the world post-covid. These growing manufacturing interests are fuelled by global OEMs and their suppliers are no far as India is becoming a vital junction for global supply chain for aerospace components and precision tool parts.

The reason behind the growing hub for these supply-chain is the existing technical know-how, talent pool and low-cost yet top-end quality product offerings by domestic companies. In addition, the geographical positioning of India enables global OEMs and its suppliers to easily manufacture indigenously and thereafter export.

Worth mentioning regardless of technological sectors, India already has young-ready workforce to drive the growth in the Aerospace and Defence (A&D) market in India. The revolution what India brought in the IT and Automobile Industries is easily being replicated in aerospace and related components and services sector.

Many private companies have already made rapid strides in developing India as a preferred destination for aero structures, components, sub-assemblies and complex system assemblies. Leading global OEMs have already established JVs in India for the manufacturing of aerospace related parts and assemblies which find their way into many commercial and defence aircraft and helicopters.

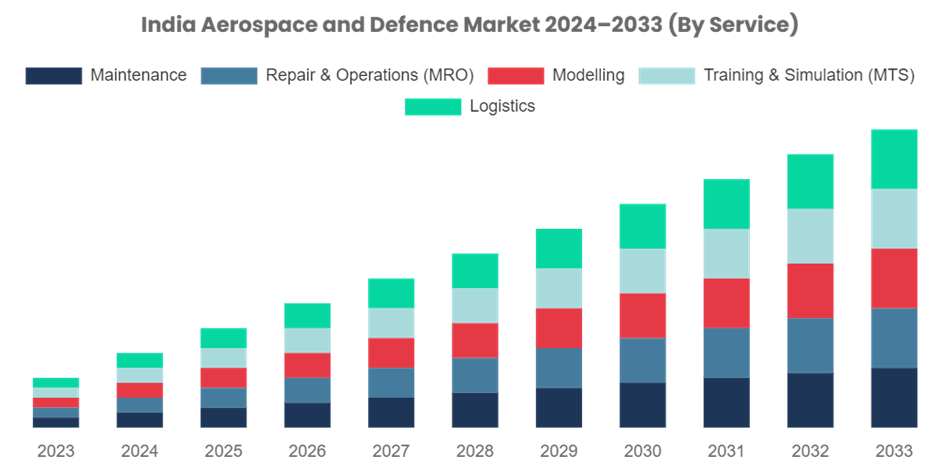

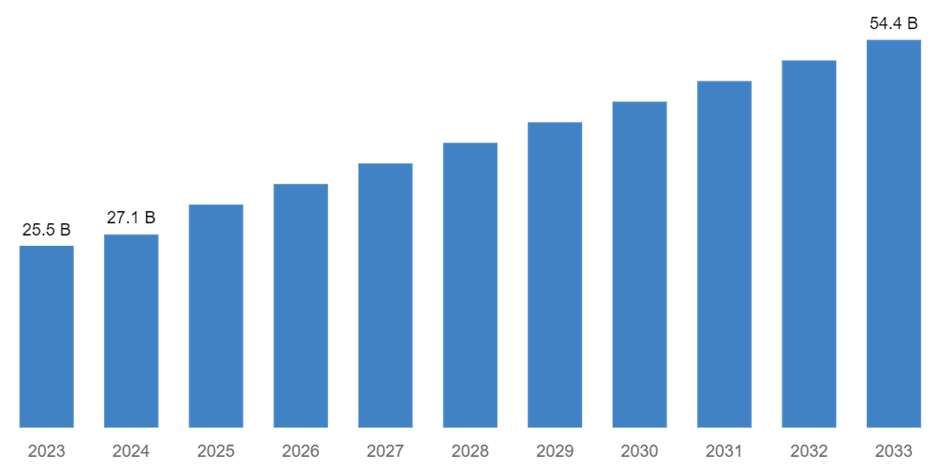

In this backdrop, India Aerospace and Defence Market is expected to reach USD 54.4 Billion by 2033, at a CAGR of 6.99 percent during the forecast period 2024 – 2033. The Aerospace and Defence sector in India involves building aircraft, ships, spacecraft, weapon systems, and defence equipment. This is the fastest growing segment in the Indian economy.

Further, an increase in the number of space programs within the country is expected to drive market growth significantly during the forecast period. For instance, India has launched 424 foreign satellites in the last nine years and noting that the space budget has more than doubled.

Additionally, factors such as growing commercialization in the aerospace and defence sector, growing international collaborations, growing focus on space exploration missions, expansion of defence and aerospace services and development of advanced technologies are expected to boost the production and sale of aerospace and defence equipment’s in India, thereby driving the market growth.

The USP for this sector has been that several Indian Aerospace and Defence equipment manufacturing companies have proven themselves capable of providing first-time-perfect-quality comparable to global standards. Aerospace and defence (A&D) companies sell their products and supporting services and sustainment programs to governments and private companies and other end use industries.

To support the domestic defence industry the government aims to ensure transparency, predictability, and ease of doing business by creating a robust eco-system and supportive government policies. Towards this end the government has taken steps to bring about de-licensing, de-regulation, export promotion and foreign investment liberalization.

The Department of Military Affairs (DMA) has promulgated four Positive Indigenisation Lists comprising 411 military items. Additionally, to promote export and liberalise foreign investments FDI in Defence Sector has been enhanced up to 74 percent through the Automatic Route and 100 percent by Government Route.

The government has also announced 2 dedicated Defence Industrial Corridors in the States of Tamil Nadu and Uttar Pradesh to act as clusters of defence manufacturing that leverage existing infrastructure, and human capital.

Further, to enable innovation within Defence & Aerospace eco-system there are supportive government schemes such as iDEX (Innovations for Defence Excellence) and DTIS (Defence Testing Infrastructure Scheme).

An increase in the number of national security concerns and border threats is also expected to drive the demand for defence and aerospace machinery, devices and equipment during the forecast period. Growing national security concerns and border disputes have encouraged collaboration between the Indian Government and the market players and have led to the formation of several joint ventures to effectively serve the requirements of the Indian Armed Forces.

Though at the outset things look rosy for the aerospace and defence sector in India, it is currently facing severe bottlenecks as far high cost of newer technologies, shrinking budgets, rising operational costs, infrastructure management, MRO (Maintenance, Repair and Overhaul) and a complex global supply chain, lack of high-end technologies, lengthy and time-consuming processes which is creating challenges for this crucial revenue generator to seamlessly grow upwards.

In conclusion India’s aerospace and defence sector has picked up global best practices and aligning them with quality rollout of products and services and on the other hand the government is lending its full-hearted support by way of custom-tuned, industry friendly policies to further see that this mission critical sector grows in leaps and bounds. As both pillars -Government and Industry are partnering with each other, there is no doubt this sunrise sector will seamlessly cruise in the near future.

The India Aerospace and Defence Market is segmented as follows:

By Security

- Cybersecurity

- Homeland Security

- Border Security

- Others

By Service

- Maintenance

- Repair & Operations (MRO)

- Modelling

- Training & Simulation (MTS)

- Logistics

By Application

- Land

- Small Arms

- Tanks

- Armored Fighting Vehicles

- Artillery

- Mine Warfare

- Communication Equipment

- Air

- Aircraft

- Helicopters

- Missiles

- Amphibious Warfare

- Communication Equipment

- Sea

- Submarines

- Destroyers

- Frigates

- Corvettes

- Communication Equipment

- Mine Warfare

custommarketinsight.com

India Aerospace and Defence Market 2024–2033 (By Billion)

Courtesy: custom market insight

Salient features of DAP 2020

- Reservation in Categories for Indian Vendors

- Enhancement of Indigenous Content

- Rationalisation of Trial and Testing Procedures

- Make & Innovation

- Design & Development

- Industry Friendly Commercial Terms

- Offsets

Government Initiatives

- DRDO’s Technology Development Fund (TDF) for MSMEs & Startups to indigenize cutting-edge defence technologies. 164 Technologies being indigenized, $30.8 Million funds sanctioned, 1886 experts and 5270 companies engaged.

- Under the Atmanirbhar Bharat Initiative, 72 items out of total of 214 items mentioned in 1st and 2nd Positive Indiginisation List (PIL) have been indigenised by Defence Public Sector Undertakings (DPSUs) well before their original timelines. The remaining 142 items are being indigenised within the timeline of Dec 2022.

- SRIJAN portal launched to promote indigenization. As of Apr 2022, 19,509 defence items, been uploaded on the portal for indigenisation.

- Defence Industrial Corridors: The government has established 2 Defence Industrial Corridors in Uttar Pradesh and Tamil Nadu. They together signed 108 memorandums of understanding (MoUs) with industries representing investments worth $24.45 Bn

- IDR Act: Defence Products list requiring Industrial Licences has been rationalised and manufacture of most of parts or components does not require Industrial License. The initial validity of the Industrial Licence granted has been increased from 03 years to 15 years with a provision to further extend it by 03 years on a case-to-case basis

- Promotion of indigenous design and development of defence equipment: A new category of capital procurement ‘Buy {Indian-IDDM (Indigenously Designed, Developed and Manufactured)}’ has been introduced in Defence Procurement Procedure (DPP)-2016

Strategic Partnership Model

The Defence Acquisition Council (DAC) approved the broad contours of the Strategic Partnership Model (SPM)

- The policy is intended to engage the Indian private sector in the manufacture of hi-tech defence equipment in India.

- It is an establishment of long-term strategic partnerships with qualified Indian industry majors through a transparent and competitive process.

- The Indian industry to partner with global OEMs (original equipment manufacturer) for big-ticket military contracts seeking technology transfers and manufacturing know-how to set up domestic manufacturing infrastructure and supply chain.

Different Technology Absorption Routes in Defence Sector

Co-development and Co-production: This is seen as a very effective mechanism in state-of-the-art technology induction and absorption. In joint development programs, the access to technology that individually the partnering companies / countries could not have developed is realised at substantially less cost and time.

Sub- Contracting / Contract Manufacturing: Occurs when a foreign vendor procures defence-related components, subsystems or products for export from industries in countries where the vendor has to meet offset obligations.

Joint Ventures: The technology inflows can be affected through establishment of Joint Ventures (JVs). However, the investment level remains a critical factor affecting the success of a Joint Venture.

In a Joint Venture with foreign equity participation restricted to 26%, the Original Equipment Manufacturers (OEMs), since they guard their Intellectual Property, may inhibit the collaborating partners from bringing in cutting-edge technology.

Licensed Production: The transfer of technology (ToT) to a local defence industry capable of absorbing the technology, if implemented in true spirit, where both the supplier and the recipient are competent organisations, the local industry will be able to further develop the technology and this results in leapfrog on the existing technology lag.

Maintenance ToT and Training: Long-term customer support activities have become mandatory. The training of local industrial partners and user agencies in maintenance of the system through applicable level of technology transfer ensures effective and committed maintenance support. The establishment of Maintenance Repair and Overhaul (MRO) Facility on partnership basis is an option to achieve this objective.

Shri. Baba Kalyani: Chairman and Managing Director, Bharat Forge Ltd:

The last data point you heard is that the Hon’ble Prime Minister saying that we are all heading towards Amrit Kaal. It means the time of prosperity. It is not very far. It is 2047, when India will reach hundred years of Independence and it is the dream of every Indian that we should see ourselves as the second or the third largest economy in the world.

Shri. Arun Ramchandani: Executive Vice President and Head, L&T Defence

Today about 12,000 MSME startups currently support the DPSUs and armed forces in supplying Defense equipment and providing services particularly IT and IT enabled services. However, we need to support them for further enhancement of participation by doing these things. These include: Training, Hand-holding of these enterprises, Ease of testing, obtaining certifications and facilitating the access to capital.

Dr G Satheesh Reddy, Former SA to RM, Chairman DRDO & Secretary DDR&D

Our goal is to not follow others but to become leaders and show new light to Defence Technology. Our goal is that if any country apart from India comes up with a technology, India should have already developed that technology. If our defense industry needs to survive, we cannot only look at the Indian market, we need to look at the market on a global scale where we are offering our products and technology to the entire world.

Dr S Devarajan, President, Bangalore Chamber of Industry and Commerce

With a proper roadmap, manufacturing would be the key sector by 2030. Going forward, we need to be ready for disruptions like newer technology and changes in manufacturing. Data Analysis will be critical for decision making. We need to be ready to embrace change with the changing ecosystem. We need to work for a scalable and sustainable export areas. OEM with MSMEs and educational institutions must work together towards this goal.

Shri Chandrashekar HG, Founder-CMD, Sasmos HET Technologies

Global investors want long-term business opportunities and not a short-term project or purchase-base business alone. We need to come up with a matrix to get clarity on who needs to do what and make the investment opportunity, not just about the money but also technology. Procurement needs to move more towards technological operations. The investment opportunities in India are because of its own market. The next twenty years is a golden period to achieve this.

Mr. Abhishek Singh, Senior Vice President, India and South Asia-Roll Royce

It is all about globalization and how we can really help the Indian Aerospace and Defence ecosystem to really grow and I think this is where we as international OEMs also have a crucial role to play. We from Rolls Royce have been working for six decades with partners both public and private in order to really help grow the ecosystem.

Dr. Sunderarajan Varadan, CEO, AADYAH Aerospace Pvt. Ltd.

We are living in a world where you buy a laptop, by the time you reach home it is outdated. Technology is moving at that speed and therefore, together comes the opportunities and also challenges. How do we cope with this sort of a dynamic situation? Be it space, be it Defence, be it any Industry. How do we have the manpower with the requisite knowledge. These are the challenges that we need to collectively address.

Authored By Mr B Shekhar

Executive Secretary Laghu Udyog Bharati -Karnataka and South India Bureau Chief for Pravasi India, a US- based Magazine