If You’re Not A Brand, You Are A Commodity

MSME is a very big contributor not only to manufacturing but also to the GDP so it needs to become a lot stronger

Timeline: 02 May, 2020

WHERE WERE WE

Lockdown 3.0 had begun. Areas were to be classified into three zones, namely Red, Orange and Green. It had been 40 days since the lockdown, the number of cases had crossed 37,000 with over 1,500 deaths, and the shadow of uncertainty loomed large. What was becoming certain, however, was the deepening impact on the country’s financial health, with India’s $2.9 trillion economy coming to a standstill.

Looking for words of wisdom and hope, we got to have a talk with IMTMA President and UCAM Pvt. Ltd. MD Mr. Indradev Babu; Pushkaraj Group CMD Mr. Shailendra Goswami and it greatly helped. Edited and abridged excerpts.

KEY TAKEAWAYS

INDRADEV BABU

- Manufacturing output recovery will be more U-shaped [rather than V-shaped] — the growth will pick up but it will be slow on the uptake.

- I believe that in the post-Covid world, our progress will be more holistic where we will see a balance between the ecology and the economy.

- A lack of stability has caused people to not be able to think deeply. When I say people, I also mean governments, the industry and the industry leaders. But this Covid-19 situation has given an opportunity for people to introspect. I expect a lot of changes to happen in our manufacturing sector.

- MSME is a very big contributor not only to manufacturing but also to the GDP so it needs to become a lot stronger, competitive and structured in order to attract business from China or any part of the world to India.

- We need to have more companies making products which go to B2C rather than to B2B. People need to have the ability to create products and launch them in the market.

- India’s most competitive and efficient manufacturing industry is automotive. They have a well-organized system to be very effective and efficient — they have followed the footsteps of the Japanese auto manufacturing system and so on. Their knowledge of excellence in manufacturing has to be transferred to the SMEs.

- Please also look at Indian manufacturing from a brand perspective. we will need to establish Indian manufacturing as a global brand much like the American, European and Japanese manufacturing brands. If you’re not a brand, you become a commodity.

- Quality and cost in manufacturing are not inversely proportional. Building high quality does not mean that your cost is going to go up. However, it is conversely true — when you are manufacturing poor quality you are doing it inefficiently and you are losing money.

Shailendra Goswami

- Presently cash flow management is the biggest challenge for companies — ensuring salary payments, EMIs, interests and so on.

- The recovery depends on the constraints of restoring the operations, redeploying the workforce, managing liquidity and administrative problems

- We are looking at roughly around 50 percent degrowth in a two-year period which is going to take a huge toll on the manufacturers and the industry.

- We have been more of an inward-looking society than an outward-looking society. We are very much satisfied or rather we always focused on our ROIs and short-term objectives. We as a society and an industry do not have that global outlook and [therefore do not follow] the mantras of quality, cost or delivery, which has been hitting us all along, because we were quite happy with the domestic demand of whatever the production is.

- We cannot undermine China’s capabilities in manufacturing — matching that kind of cost, volume, quality and delivery standards is going to be a big task.

- If we have to compete in the global market, the top attributes that we have to ensure are quality, cost, delivery and scalability. We need to specialize in modular manufacturing so we can be very flexible in whatever we do.

- Quality does not get compromised because then that is only the last order that you will execute. You have to believe in what you produce and you will have to provide a complete value-added proposal because a product is not sold on its price or cost, it is sold on its total life.

THE TALK

What is the situation on the ground?

Indradev Babu (IB): As you know manufacturing has virtually come to a standstill. The situation that we are going through is unprecedented. Naturally, the government had to take such precautions to save lives that is great. The government and the people of the country have come together to follow this need to be under lockdown. Naturally, this would also bring about a lot of pain, particularly to the weakest sectors and the poorest of the poor. For industries, the micro and small enterprises are facing a lot of challenges and confusion. For example, the government has said that you have to pay all the wages, so the micro enterprise people are wondering how and where the money will come from to pay the salaries. When I checked with various smaller companies who are part of the association, they’re all clueless and wondering how they are going to be able to manage. They are eagerly waiting for this special stimulus package the government is planning to come out with.

That is one side of the story. All said and done, people are holding on, the situation is tough. From today’s news, we saw that the wheels of Industry could start to move again slowly I guess. I think the government is doing a wonderful job. As you know from the association’s side I’ve been taking part in various discussions with ministries both at the centre and the state level, so I’m aware of what the government is doing and [my perspective is that] they’re really working around the clock and doing their best.

Shailendra Goswami (SG): The situation is highly unprecedented and we have really clocked almost five to six weeks into it. I can remember that the last I walked out was on the 20th of March, and ever since I’ve been staying at home, working from home like everyone else. From a macro perspective, there was lockdown 1.0, followed by 2.0 and now there is a lockdown 3.0. Controlling the pandemic is the foremost priority that everyone agrees to. I was listening to a renowned economist, who said an important thing about these measures, that we need to do a balancing act between saving lives and livelihood, one cannot be [prioritized] at the cost of another.

I’m extremely happy to see that all the governments, whether it the state or the central government, have been putting in a lot of effort to do this tightrope-walk, where they have been trying to satisfy every sector. Compared to the world we have done very well so far.

The industry has been facing phenomenal challenges, whether it is around restoring operations, or business continuity during the lockdown, which the government has eased in the rural belts or the SEZs. In addition, cash flow management is the biggest challenge — ensuring salary payments, EMIs, interests and so on.

Supply chain management is another issue — although the cargo movement has started, hardly 15 to 20 percent of the number of trucks have really been taken into operation.

And of course the biggest challenge regarding the workforce, their safety and morale.

What does your instinct say about when and how we will see a recovery and whether it will be a V or W-shaped recovery?

IB: Manufacturing output is proportional to market demand. So I believe that it will be more U-shaped — the growth will pick up but it will be slow on the uptake; not steep like a V-shaped growth. It would take at least a one-year period of shallow growth, because as the wheels will start to rotate after the lockdown, it will start a certain but gradual chain reaction, and then the demand will start to pick up.

For example, automotive is a big industry in India — it comprises nearly 49 percent of the manufacturing GDP. And now this has completely come to a standstill. Whether the demand will return in the same way or not will be a question of sentiment. Which mode of transport will people prefer and feel safe in: will it be two wheelers or cars or public transport?

This present difficult phase is not going to last just a few weeks or months, it will take a year and a half or maybe two years, and then you will see a very steep rise; because mankind is such that we always need to be building something. Sometimes it looks like mankind is destroying the environment but, finally it is the socio-economic environment that political and business leaders stand to gain from. I believe that in the post-Covid world, our progress will be more holistic where we will see a balance between ecology and the economy.

SG: On the manufacturing side, the recovery depends on the constraints of restoring the operations, redeploying the workforce, managing liquidity and administrative problems. I feel that manufacturing will follow a gradual recovery, rising [post-Covid] from perhaps 30 percent to 70-75 percent at the most and not 100 percent in next five or six months.

The most important aspect is the demand generation, which is very critical because as it is, if we take the automotive sector, we have seen a degrowth during the last 18 months of around 20 to 25 percent, owing to a number of factors like the transition to the new emission norm, changing mobility preferences of people and policy implementation like GST and the scrappage policy. Then the process of restoring the operations will last for another year or so, during which time we might experience another degrowth of around 20 to 25 percent. So what we are looking at is roughly around 50 percent degrowth in a two-year period which is going to take a huge toll on the manufacturers and the industry. The first and the foremost area of focus is going to be demand generation which will come only when we have money in the pockets of our customers.

In terms of paving a way to recovery, in a recent ACMA (The Automotive Component Manufacturers Association) meeting, we discussed Five Rs — Resolve, Resilience, Restart, Reimagine, and Recovery. The resolve should be to get your bearings right, resilience is the never-say-die attitude, reimagine is to focus on the new future that awaits you, recovery is going to be the growth in the new normal market scenario.

Has the manufacturing industry been hit harder because of the deeper, existing vulnerabilities? If so, what are they?

SG: This is absolutely true. We have been more of an inward-looking society than an outward-looking society. We are very much satisfied or rather we always focused on our ROIs and short-term objectives. We as a society and an industry do not have that global outlook and [therefore do not follow] the mantras of quality, cost or delivery, which has been hitting us all along, because we were quite happy with the domestic demand of whatever the production is.

There was a recent study conducted by Nomura in which they looked at some 56 companies relocating from China, and noted that only three out of those 56 companies came to India; 26 went to Vietnam, 11 went to Taiwan and eight went to Thailand.

When we talk about the future, we need not be complacent that well with China down, India will gain. We need to think twice before making that kind of a conclusion because there could be a possibility that China might come out stronger out of all this. We cannot undermine China’s capabilities in manufacturing — matching that kind of cost, volume, quality and delivery standards is going to be a big task.

That said, whichever international company wants to relocate to India, a favorable government intervention will help us with that. I am happy to share that our government is taking stock of this subject and preparing a strategy paper which will be submitted for approval to the cabinet. This strategy paper will focus on investments to be put in by the government to create additional SEZs, creating a single-window clearance system, helping us move up on the ease-of-doing-business parameter.

There is a commitment from the industry side — once the government and the industry come together on this vision, I am sure India will become the most attractive destination for FDIs, relocating and outsourcing.

IB: I agree with Mr. Goswami. We are typically short-term oriented; we don’t plan things with a long-term perspective. I think this is because of how our country has evolved, it has been the case that things have been changing very dynamically. A lack of stability has caused people to not be able to think deeply. When I say people, I also mean governments, the industry and the industry leaders. But this Covid-19 situation has given an opportunity for people to introspect. I expect a lot of changes to happen in our manufacturing sector.

I feel that MSME is a very big contributor not only to manufacturing but also to the GDP so it needs to become a lot stronger, competitive and structured in order to attract business from China or any part of the world to India. Government has to help with ease of doing business and bring in enablers to help MSMEs. The time has come for MSMEs to become more innovative and productive. They have to grow beyond the Jugaad mindset into organized innovativeness. Instead of being more service or job shop oriented, MSMEs will have to learn to become more creative and manufacture better, innovative products.

Of course, supply chain is a critical building block for any type of manufacturing. We need to have more companies making products which go to B2C rather than to B2B. People need to have the ability to create products and launch them in the market. When they launch in the market they have to survive in competition with international products and when that happens they will learn to become competitive.

India’s most competitive and efficient manufacturing industry is automotive. They have a well-organized system to be very effective and efficient — they have followed the footsteps of the Japanese auto manufacturing system and so on. Their knowledge of excellence in manufacturing has to be somehow transferred to the medium and smaller companies. What the government should do is to bring in suitable enablers or programs through which this could get transferred. It’s not easy because we Indians culturally find it very difficult to be organized. It’s pretty difficult but such initiatives have happened in India before and it can happen again.

Everybody feels that China manufactures the cheapest products. Not true. To share an example, there’s a company in our association called Pragati Automation, which produces turrets which are best-in-league in terms of price, performance and quality, and have a big market in Germany China. I know of many other companies including my own company that competes with high-tech products and companies globally. So India can do it.

Please also look at Indian manufacturing from a brand perspective. we will need to establish Indian manufacturing as a global brand much like the American, European and Japanese manufacturing brands. If you’re not a brand, you become a commodity. It’s time that Indians develop and produce brands, even in the MSME space.

Let me put a dramatic spin on a question I’ve always wanted to ask our industry leaders. There was a Bollywood movie called Nayak, released in 2001, a remake of the Tamil hit movie Mudhalvan. The hero of that movie is made the chief minister of a state for a day, and is asked to fix all the big problems. My question to you is, if you are made the CEO of India’s manufacturing sector, what are the top things you will do to transform the sector, never mind the resource constraints or the time involved.

SG: To my mind if we have to compete in the global market, the top attributes that we have to ensure are quality, cost, delivery and scalability. We need to specialize in modular manufacturing so we can be very flexible in whatever we do.

Then as pointed out by Mr. Babu, we must learn to innovate and the part where we fail miserably is the logistics efficiency and excellence. We have to fix that and also create value-add centers in strategic overseas locations. You know these are a few things which I would like to implement if we have to become a global player.

IB: Interesting question. So if I become the CEO of India’s manufacturing, the focus area will be to ensure that India’s manufacturing becomes globally competitive. To enable that I am going to form teams comprising top people, thinkers and doers, gurus — and I am fortunate to know many of them in the north, south, east, and west. Below them they will have executive teams that will work with the SMEs. I want to focus on small companies and not the big companies. Big companies can take care of their own [future], and they’re already doing it. They know that being productive, being competitive means ensuring a robust bottom line.

Item two 2 would be to provide training in manufacturing at a big scale. Generally speaking, our engineers are not top-notch. If we provide the right training for our engineers to be sharper, they could contribute directly into the industries they join. IMTMA is doing a very good job with an initiative called Finishing School In Production Engineering. It is a wonderful thing. The industry really grabs up engineers from this training program. Such types of programs should be implemented throughout the country.

The third area is improvement of logistics. Fourth is the industrial infrastructure. For example, a lot of industrial estates are located in places which have pathetic infrastructure including that of approach roads. Not only does that make you lose efficiency, the poor quality gives a bad impression as you go into your company. There are a million things to do but these four areas I would give a top priority to.

Audience question: How do you see the trajectory of demand for machine tools moving hereon?

IB: The demand for capital goods including machine tools would be much lower this year. It will take a while for the demand to pick up. That said, there is a big pull from the medical sector; particularly pharma, medical devices particularly the PPEs and the ventilators.

In the longer term, metal forming and mold making could pick up demand. Also laser processing. I believe in a year’s time newer industries will pick up and in about two years you will see a very steep climb for machine tool requirements. Manufacturing will pick up in India and there will be some focus drawn away from auto manufacturing toward these newer sectors.

SG: Our focus has to be global market oriented. Any company which makes products driven by the market will survive. The situation is going to change so the marketing books will have to start writing something else now. The books which we learned in always had a product-based marketing system, but going forward markets are going to demand products, therefore companies must prepare themselves accordingly.

To share an example, I was personally being coaxed by one of my very senior friends to get into healthcare which I never really looked at, being an engineer and being in the industry of manufacturing for the last 40 plus years — I always ignored that.

For the last two years, I have been advising people in manufacturing to look for avenues in non-automotive [sectors] which could be defense, aerospace, or space technology, much like how Bharat Forge has entered the defence sector [and moved from being a components maker to a finished good manufacturer].

In the healthcare sector, medical equipment is more of an electronics product. If you look at, say, a Covid facility, where the patient is admitted you will see nothing but wires, oscilloscopes and instruments. There is hardly one mechanical gadget which is fabricated, except the hospital bed. Everything is electronic, even the bed is controlled by electronics. Like we say that nowadays in a car 40 percent of it is electronics; similarly in healthcare electronics is playing a major role. There are already forecasts that India will become one of the biggest exporters in the area of healthcare, whether it is medical electronics, equipment, medicines, pharmaceuticals, homeopathy or ayurveda.

Then there is another area which is significant: It is digital transformation or the digitalization of the industry. I will extend it to e-commerce [for machining sales]. One of our US principals has already started using an online portal where he conducts his sale of engineering items like vibration switches on e-platforms. This saves a lot of cost.

Food processing is another area that has become significant. We don’t know how long this lockdown is going to last. Consumers need to have food which is processed, which could also be exported. This will also help utilize the 40 percent of agricultural produce that goes waste everywhere.

IB: Certainly. Manufacturing for IT and IT-enabled services is very important and is going to pick up. IT requires several molded parts and metal parts that would give up opportunities for manufacturing but then again, a lot of its components are sourced from China. There are also some very good Indian manufacturers, but more Indian companies need to get into this area.

The core solution first is that if you want to do anything, you need to get competitive, and now this is the time. In fact this crisis has given a huge opportunity for introspection. I would call upon every company to reflect on how they can become more competitive, how they can sustain and succeed. how they can become profitable. They need to go beyond and grow after this as the new opportunities will come. It’s going to be a new sunrise, that’s for sure.

Audience question: What will be the effect after this pandemic on the machine tools export business?

SG:- CNC machine parts is one of the exports I do. To answer your question, there is not going to be much of an effect on your existing businesses, because exports opportunities to the US and Europe have increased due to the Sino-American trade war. In fact your businesses will grow further if you take certain proactive measures. You need to create a local base either yourself directly or through some people and see to it that your presence is felt. Europe has always been a country where they do not keep changing suppliers just like that. So I don’t see any problems or hiccups as far as Europe and US markets are concerned for exporting from India — in fact such opportunities should increase.

Audience question: considering the ongoing crisis, will customers in the manufacturing space, like automotive companies, look for cheaper solutions even if they come at the cost of quality?

SG: The answer is a straight no. Quality does not get compromised because then that is only the last order that you will execute. You have to believe in what you produce and you will have to provide a complete value-added proposal because a product is not sold on its price or cost, it is sold on its total life. It’s like any other comparable product like, say, a Sony TV which will be the same after many years, whereas a cheaper model with the compromised quality will have to be replaced 3-4 times. So I would go by the quality rather than the cost. It is through your marketing effort that you will need to convince the customer as to why your cost initially is higher but then in the longer run it will be cheaper.

IB: I would like to add here that quality and cost in manufacturing are not inversely proportional. Building high quality does not mean that your cost is going to go up. However, it is conversely true — when you are manufacturing poor quality you are doing it inefficiently and you are losing money. When you have the same input and have to produce the same kind of product with a generic specification, you can definitely be cheaper and yet produce a better quality product. Please understand that as the world is evolving, a better quality is expected; there is no opportunity for poor quality products.

Audience question: I need to know the prospect of a new entrant into the automotive industry.

SG: You must understand that automotive is a very competitive and a highly quality conscious market. When you are buying a car you are expecting the car manufacturer to give you a five year warranty which means several hundreds of thousands of kilometers. So the quality is supreme and at the same time you want that particular car to be the cheapest one. Therefore if you can work out a combination like that in your manufacturing setup then you are in for playing ball as far as the automotive sector is concerned. But a word of caution is that there are too many players already in it. And there’s so many component manufacturers that you need to find a real niche which really gels with your core competences. Then only I think you will be a long-term player.

IB: You have to pay attention to the coming trends — for example, during Covid-19 not many people would want to take a taxi so shared mobility is going to suffer. If somebody comes up with a car with a differentiator where, say, all you need to do to disinfect a car is press a button. So you need to come up with something which is attractive from the safety and/or hygiene point of view. Much has changed on this front, because after Covid 19 we may have a Covid 21 or something. So the whole mindset around health, safety, and hygiene is permanently set for us now. Therefore the auto industry is going to evolve on these lines.

Suddenly now millions have learned to work at home and they’re even wondering what is the need to go to an office? So IT companies won’t need so much of an office space. I really worry about the real estate people.

Audience question: Do you think private mobility will get a boost in the absence of public transport?

IB: I definitely think that the people would prefer to drive in their own vehicles in the near term until the fear of Covid 19 goes away from people’s mind. You would want to use your own vehicles even for a longer travel, rather than taking a flight. Let’s say I want to go to Chennai or Hyderabad or even Goa, I would prefer to go by car. There would be a need for more personal vehicles but maybe with a different aspect. Auto companies are all innovating right now.

SG: Theoretically speaking, yes, the demand has to go up. Presumably, people who were travelling earlier by public transport or rideshare will prefer their own vehicles so that would add a certain percentage. The banks will be extending loans for creating demand; apparently the GST council is thinking of recommending that GST should go down [on cars] or that the depreciation should be added to that extent the demand will go up. Social distancing is going to be the biggest phenomenon as far as demand generation is concerned.

Lastly, what is the message that you have for all the viewers on how to deal with this situation and the future outlook?

IB: These are tough times and tough times bring out the best in us. Indians have the strength of managing excellently during adversity. Let me tell you that the Indian manufacturing industry will come out shining, with a new vigor and vibrance. But presently we have a period of tough situations during which we have to pull ourselves together. So be clear minded and stay focused to sustain initially and reap the opportunities and then grow beyond that. All the best to all the manufacturers.

SG: By nature I’m an optimist. I always see things in a positive mode. We have a saying in Marathi: “ek daarah banda jhala ki daha daarah ugadtat” (when one door closes, ten doors open). One must have that wisdom and intellect to focus his and her attention on those ten doors that will open rather than the door which has closed on him. Be optimistic and be positive.

Seventeen Samurai: Executive Profile

Indradev Babu

Mr Babu is MD, UCAM Private Limited and President, IMTMA (Indian Machine Tools Manufacturers Association). IMTMA is the apex industry body of machine tool makers and is the organizer of the industry flagship event IMTEX. In 2018, IMTMA felicitated Mr. Babu with the Premier Outstanding Entrepreneur Award – instituted in memory of Vinod Doshi.”

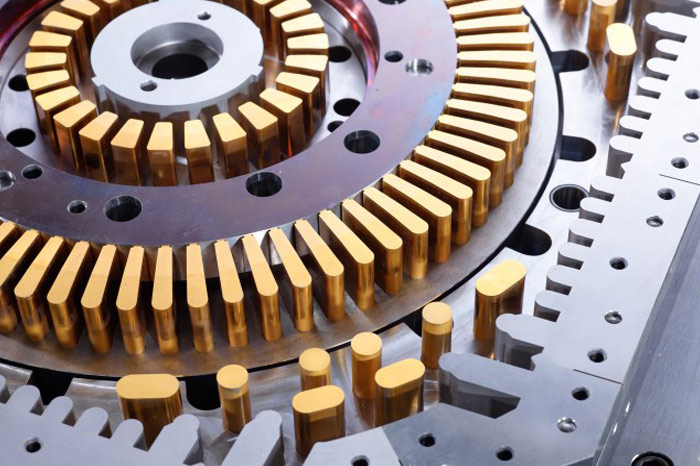

UCAM is a leader in India for CNC rotary tables, high performance CNC gear, hobbling machines and high-performance stock motors. The company believes in the philosophy Make in India for the world and offers technologically advanced products to the world market.

Shailendra Goswami

Mr. Goswami is CMD, Pushkaraj Engineering Enterprises Private Limited and Coherent Networking Solutions Private Limited. He is also associated as an adviser and mentor with Aditya Enterprises and Tanmay Enterprises.

Pushkaraj Group represents and distributes products of 32 leading companies from around the world to diesel engine manufacturers, automotive manufacturers, engineering industry, national research industry, oil and gas sector, shipbuilding yards, compressor manufacturers etc.